"valsidalv, reminding you that infiniti is an option" (valsidalv)

"valsidalv, reminding you that infiniti is an option" (valsidalv)

08/13/2020 at 18:40 ē Filed to: stock market, Aston Martin

1

1

22

22

"valsidalv, reminding you that infiniti is an option" (valsidalv)

"valsidalv, reminding you that infiniti is an option" (valsidalv)

08/13/2020 at 18:40 ē Filed to: stock market, Aston Martin |  1 1

|  22 22 |

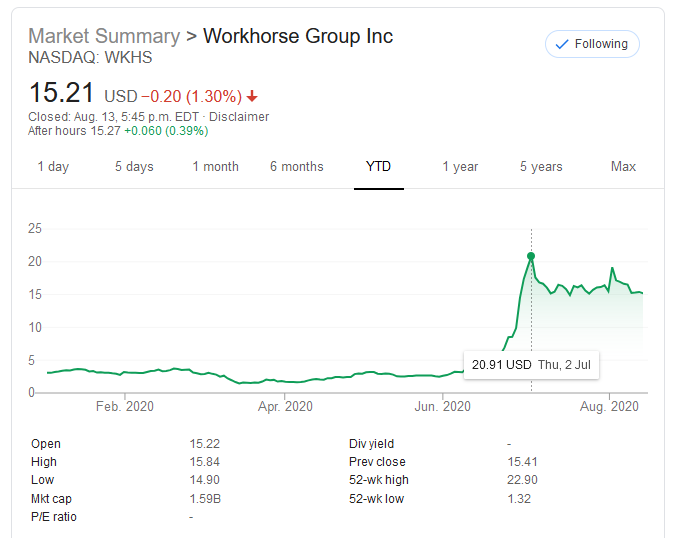

Last year I started following the journey of Workhorse after it was featured in a Jalopnik article back when they were talking about !!!error: Indecipherable SUB-paragraph formatting!!! . At that point their stock (WKHS) was in the trash, hovering at the $1.50 mark. I started keeping track of the price and any news about them. Well, that was a mistake, because the market reacts very quickly to news that analysts find out well before I do. In June this happened:

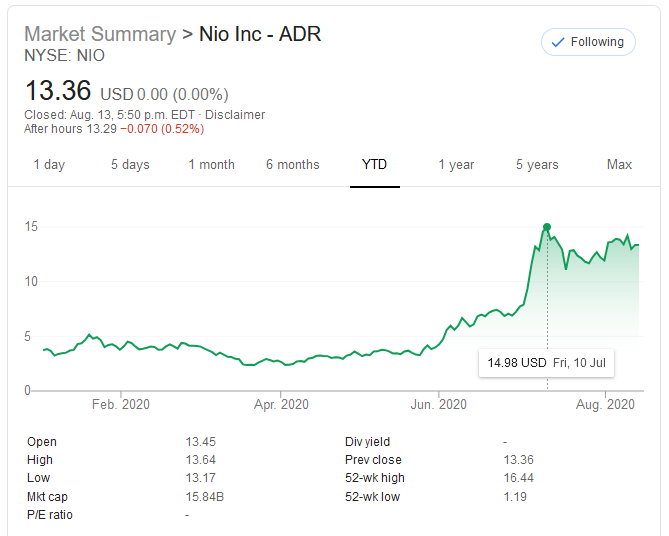

It skyrocketed from $2.63 to a maximum of almost $23, and has now settled around $15. The same happened to Chinese EV maker NIO in July:

Hey, Iím still kinda new to the whole investment thing so Iím taking this on the chin.

Letís turn our attention to Aston Martin, which has 3 different stock symbols but Iíll focus on Aston Martin Lagonda Global Holdings PLC (AMGDF):

Itís currently a penny stock!! So there might be a decent opportunity to make a few bucks on it unless the company completely folds. My question is: what does the future hold for AM?

They are building the DBX and we all know how well SUVs are doing, even expensive luxury ones.

Lawrence Stroll is at the helm and I think thatís a good thing . I can understand the logic in taking a look at F1 landscape and proposing an idea so crazy it just might work: copy the champions. Despite the turmoil itís caused it really is a brilliant business move.

Hybridization is on the horizon for many models, with an EV coming much, much later than it should (2025)

Is there a chance AM will cease to exist in a while?

Tripper

> valsidalv, reminding you that infiniti is an option

Tripper

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 18:58 |

|

Not available on Robinhood:( I think E*TRADE is $10 or more now.

valsidalv, reminding you that infiniti is an option

> Tripper

valsidalv, reminding you that infiniti is an option

> Tripper

08/13/2020 at 19:14 |

|

Iím in Canada - Questrade is lyfe yo.

facw

> valsidalv, reminding you that infiniti is an option

facw

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 19:25 |

|

Still a $1.5B market cap. A little too much to pass the cap around Oppo and buy it if only to get us a cool wing logo.

Manny05x

> valsidalv, reminding you that infiniti is an option

Manny05x

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 19:49 |

|

I bought it back when you first posted about it here. I was looking for a stock to buy and i chose workhorse. Thank you.

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 20:13 |

|

AM has died like a thousand deaths and itís still around so this wouldnít really be the first time it died . Iím not a huge fan of option trading but maybe go that route so you just lose the contract cost in the worst case instead of everything.

Iím not bullish on them. Look at Mclaren, who needed a huge loan just to make payroll. AM is not remarkably different - reluctant to change and capitalize on high margin stuff. Companies who are allergic to money like† that donít typically stick around.

themanwithsauce - has as many vehicles as job titles

> valsidalv, reminding you that infiniti is an option

themanwithsauce - has as many vehicles as job titles

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 20:46 |

|

Oh hey, I got in on workhorse a few months ago and flip/day-trade it a little bit. Honestly, my take on the stock market is it is a moodboard, not a true reflection of the market. A merger or restructuring could see the stock become worthless or get absorbed into whoever buys it. If that happens, youíll probably get a X for 1 share conversion so if the new companyís stock is say 20$/share and AM is 1$, you might get 1 share of the new company for every 20 shares of AM you have. You might make money in the very long run, but I doubt AM will be a rapid mover unless it gets bought out by a SPAC - a dedicated firm with liquid billions of capital who are looking for a project.

You want insanity? Check out Nikolaís stock. It hit some crazy high numbers and is still trading in the 30s despite being much further behind workhorse and the lordstown motors group. Or check out some of the SPAC stocks out there like DPHC, SHLL, and SPAQ. Al

l are tied to an EV manufacturer for a merger or buyout of some kind and that is literally all they are trading on is the merger talks. ANd yet.....they gained a lot fo money, very quickly. I myself made a couple grand off of DPHC just last week.....The stock market is kinda BS.

E90M3

> Tripper

E90M3

> Tripper

08/13/2020 at 20:54 |

|

Itís on TD Ameritrade, which has free trades. Thatís what I use.†

valsidalv, reminding you that infiniti is an option

> Manny05x

valsidalv, reminding you that infiniti is an option

> Manny05x

08/13/2020 at 21:37 |

|

I am glad you made something from it!

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

08/13/2020 at 21:38 |

|

Do you think thatíll be the case even with Stroll around?

PatBateman

> valsidalv, reminding you that infiniti is an option

PatBateman

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 21:40 |

|

Take 95% of the money you plan on investing and put it in a well-diversified portfolio of ETFs and mutual funds that properly reflect your time horizon, risk tolerance, and goals for the funds. Rebalance this portfolio twice per year, and during sudden market movements (unless taxes are a big deal for you and youíre in a high bracket).

The remaining 5%? Invest in whatever you feel like throwing it into. The caveat is you must understand that if it makes† money, itís because you got lucky (which is fine). Be okay with losing it, too, because thatís what happens mostly with penny stocks.

Thank you for coming to my TED Talk.

valsidalv, reminding you that infiniti is an option

> themanwithsauce - has as many vehicles as job titles

valsidalv, reminding you that infiniti is an option

> themanwithsauce - has as many vehicles as job titles

08/13/2020 at 21:44 |

|

Unless you really, really,

really

know

everything

then itís a gamble. In other words, itís almost always a gamble.

That being said I bet on AMD a year back because I knew their Ryzen 3000 series CPUs would knock it out the park, and that Intel was struggling to keep up in terms of production process. Either way I still got lucky because I had no way of knowing their server market share would dramatically increase which is really driving their profits.

valsidalv, reminding you that infiniti is an option

> PatBateman

valsidalv, reminding you that infiniti is an option

> PatBateman

08/13/2020 at 21:46 |

|

Thank you for the presentation.

I 100% agree, Iíve just been lazy on finding an ETF that suits my needs. But I will do that.

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 21:50 |

|

After the Mclaren thing? A good CEO right now has got to be thinking about taking the company private and trying to fuck over the shareholders in the process . Just remember that CEOís who come in during desperation times typically will sacrifice long-term outlook for short term gains because it preserves their own job. AM could definitely turn things around, but the shareholders could certainly be in for a bumpy ride. Performance and share price are not connected in times like this , which is probably why Stroll & the accounts are probably trying to totally decouple them ASAP.

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 21:53 |

|

Put it in ultra-short term bond funds and take a low yield at least until December/January... †any equity- based ETF is a massive risk right now. Buy at the bottom, not the top, and we are nowhere close to a bottom right now.

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

08/13/2020 at 22:05 |

|

Points taken. Thanks for the explanation!

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

valsidalv, reminding you that infiniti is an option

> notsomethingstructural

08/13/2020 at 22:08 |

|

Well looks like

Iím spending the rest of my night on Investopedia.

Napoli

> valsidalv, reminding you that infiniti is an option

Napoli

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 22:10 |

|

Janus Balanced is a great solution if you donít want to build a portfolio of a dozen different mutual funds/ETFs. Itís been around since 1992 and has pretty much tied the returns of the S&P 500 with a third less risk.†

themanwithsauce - has as many vehicles as job titles

> valsidalv, reminding you that infiniti is an option

themanwithsauce - has as many vehicles as job titles

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 22:19 |

|

If you actually do know *everything* and then use it to trade stocks, thereís several laws against that...

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

notsomethingstructural

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 22:33 |

|

I did a cash-out refi on my house and thatís where I have it parked. Most investment managers agree that the market is unusually strong because itís not overtly BAD in the economy right now. The Fed and congress are doing their best. And rich people have nowhere else to invest it when interest rates are terrible, bond yields are terrible, and the fed is out competing with institutional investors to buy corporate bonds. So taking a risk on stocks doesnít seem so bad for people who can either take a loss as a write-off or let it ride.

Come November when Republicans suddenly say we canít do any more virus stimulus and start pressuring the Fed to slow down some of their ďtailspin recoveryĒ methods, the market is gonna tank if thereís not already a vaccine getting stuck in peopleís arms.

If youíre looking on investopedia, I would look into how call option contracts work if you basically want to place a bet on AM on margin, and yeah I would look at some bond ETFís.

[ETA: just remember that no investment is permanent. If you think the market might dip, itís perfectly valid to sit a few plays out and jump in later. You donít HAVE to invest in an overheated market]

Nauraushaun

> valsidalv, reminding you that infiniti is an option

Nauraushaun

> valsidalv, reminding you that infiniti is an option

08/13/2020 at 23:56 |

|

Some say the DBX is too late to really make the money. Given the X5 has been with us 2 decades, the Cayenne almost as long, the Macan since 2014, the Urus has been around more than 2 years, the F-pace more than 3. Makes sense. Even Maserati have been in the game 3 years, and theyíre worse than Alfa when it comes to things like success.

Maybe theyíd have more success in the EV game - but theyíre horrendously late to that as well.

I hope they do well, and they may. But theyíre late to the party they are...

Manny05x

> valsidalv, reminding you that infiniti is an option

Manny05x

> valsidalv, reminding you that infiniti is an option

08/14/2020 at 07:10 |

|

Yeah thank you, i bought 40 shares lets see where it goes.

PatBateman

> notsomethingstructural

PatBateman

> notsomethingstructural

08/14/2020 at 11:24 |

|

Iím just going to tell you this: donít give investment advice like that. Notice I said some VERY broad things to do with invested funds. You donít know where the top or bottom is, and anyone pretending to know i s either a liar or a fool. Please donít be either of those.

Respectfully,

-A guy with two decades of experience in finance and wealth management